As part of our ongoing commitment to providing you with everything you need to know about UK property, we’re introducing the Platform Property Market Update, reviewed quarterly to make sure you’re up-to-date and in the know.

Amidst a backdrop of economic uncertainty, the UK housing market has experienced a subdued start to 2023. Driven by rising borrowing costs and an increased cost of living, there’s no surprise that activity has slowed, reflected by a natural correction in the market. Below we explore how the housing market has reacted to a new year and what that looks like for house prices, reservations, transactions and local market activity.

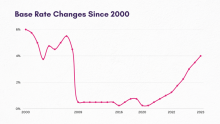

1.Interest rates continue to rise

In a bid to support the housing market, interest rates have steadily risen over the last year, culminating in another increase of 0.5% to an overall total of 4% in February.

While this is impacting mortgage costs for buyers, experts suggest that inflation has ‘likely peaked’ and a potential recession will be much less severe than previous data showed. Incidentally, this means that interest rates may now settle, avoiding potential increases to the highs of 8% that were suggested last year.

According to Simon Rubinsohn, Chief Economist at RICS: ‘The overall tone across the housing market is subdued, which is expected after the jump in mortgage rates last year.’

2. Positive reservations suggest a bounce-back

Optimism should be taken from the positive interest we’ve seen in the housing market since the start of the new year, especially if

we see a less hostile economic environment than previously expected.

While economic uncertainty has led to reservations declining, the overall reservation rate improved in January 2023 compared to the six months prior. The important thing to consider will whether the market can maintain this momentum over the coming months.

Seasonally adjusted data is also positive, with government data showing that the number of residential transactions in the UK during December was 101,920 - 1% higher than the year before.

3. UK house prices suggest a potential correction

Data from the UK House Price Index - the most reliable snapshot of house prices in the UK - suggests that despite prices falling by 0.3% in November 2022 (the most recent data to hand), year-on-year growth is sitting at 10.3%.

Even despite the uncertainty of the last 12 months, government initiatives and the sheer level of demand in the market have sustained the UK property market and led to increased growth. Now, due to higher mortgage costs, that growth is being subdued and prices are changing to reflect this.

It’s important to remember that house prices are also currently elevated, having seen an unprecedented run of growth since the COVID pandemic. What we’re likely seeing is a natural market correction in prices. For new and first-time buyers, this may mean an opportunity to save money in some areas where growth is subdued.

Anecdotally, a number of estate agents are also currently highlighting the significant demand that remains across the market - especially as supply is still low in many popular areas - which may mitigate any serious price drops.

4. Rise in Shared Ownership applications and products

While the number of Shared Ownership products fell during Summer 2022, the market settled during Q4 2022 and now many lenders are offering a wider range of mortgage products. In November, the number of products increased across the board, with the largest increase occurring in products that represent a 95% LTV.

With 83 products now available for buyers with a 5% deposit, we’re definitely seeing signs of a healthier market. Similarly, the total number of lenders operating in the Shared Ownership space has increased to 27, with the total number of SO lenders offering 95% sitting at 18.

In terms of applications for Shared Ownership, Metro Finance reports that across 2,400 assessments over September, October and November, open market sales have slowed and most activity is in affordable schemes.

With demand falling in the open market and a 22% rise in income occurring for shared ownership buyers, it’s logical that open market buyers will continue to move into the shared ownership market during 2023, which will contribute to healthier shared ownership demand and lending.

5. Introduction of the ‘Right to Shared Ownership Scheme’

In December 2022, the government opened up applications for the Right to Shared Ownership Scheme which applies to residents in social and affordable housing built with the support of the government’s Affordable Homes Programme 2021 - 2026. Residents living in these properties might be eligible for the scheme provided:

- The social tenant has been in social housing for three years

- The social tenant has lived in a qualifying home for a year

Under the scheme, eligible residents can buy an initial share of their home worth between 10% and 75% of the market value, either in cash or via a mortgage. Through staircasing, this can be increased to 100%.

6. Local markets excel in the Midlands

As one of the most popular and affordable areas in the country, the Midlands remains a key market for property transactions and Shared Ownership applications.

According to data from the House Price Index, the average house price in the West Midlands is £256,900 and on average, house prices in the West Midlands have increased by 12.3% (or £28,000) over the last year. The West Midlands has a significant spread of house prices, ranging from around £145,000 to £400,000.

Looking to the other side of the Midlands, the average house price in the East Midlands is £253,000 and on average, house prices in the East Midlands have increased by £12.2% (or £27,500) over the last year. The East Midlands has a significant spread of house prices, ranging from £178,000 to £383,000.

For buyers, the centrality, affordability and quality of living in the Midlands is extremely appealing and it’s this demand that is supporting the housing market across the region.