Langley Chase

Discover 2 & 3 bedroom new build homes for sale at Langley Chase on Radbourne Lane, Mackworth through Shared Ownership

Share this development

The development

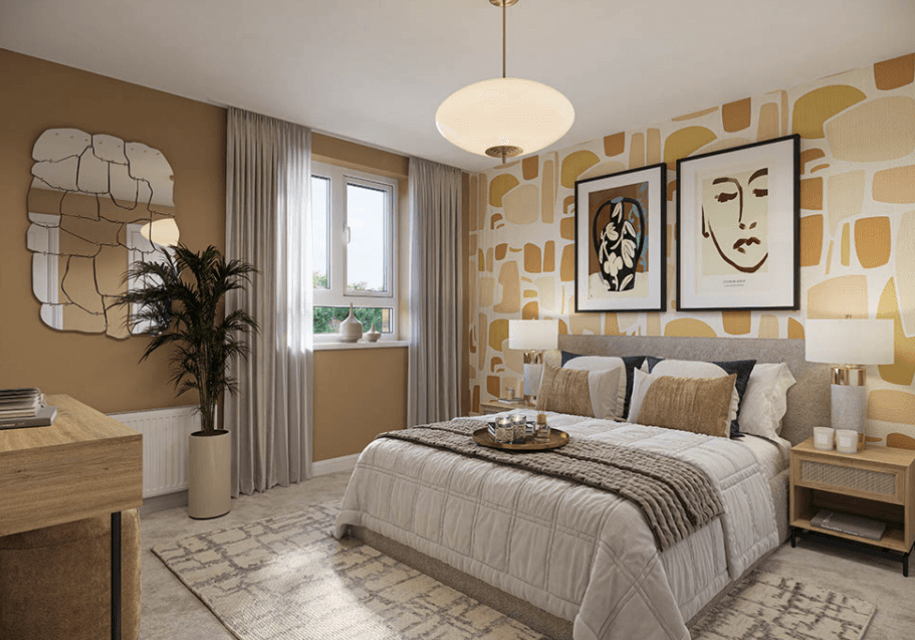

Langley Chase is a vibrant collection of two and three-bedroom homes for sale in Derby, all available under the new model of shared ownership.

Langley Chase is a collection of 23 homes for sale in Derby, specifically designed to offer urban contemporary living and perfectly positioned to take advantage of the city’s eclectic mix of amenities.

For buyers seeking two or three-bedroom homes in Derby, Langley Chase is a prime opportunity to buy through the new model of shared ownership.

Around a 10-minute drive from Derby City Centre, Langley Chase is ideal for buyers who want to enjoy the vibrancy of the city without necessarily living in the middle of it. Residents of Langley Chase have the best of both worlds - beautiful green spaces, walking trails, cycling paths and sports facilities in the nearby Markeaton Park alongside the bars, restaurants and boutique shopping available in the city itself.

Local convenience stores, a post office, and a pharmacy are just a short walk away, while the nearby Kingsway Retail Park is also home to several major retailers, a gym and a rock climbing centre. As you’d imagine, Derby is home to a large number of different schools, the majority of which are rated ‘Good’ but 14 of which are rated ‘Outstanding’, making it ideal for families moving to the area.

At Platform, we’re excited to be supporting this amazing new development, ensuring residents have an opportunity to buy shared ownership homes in Mackworth, Derbyshire. Langley Chase represents a new neighbourhood for Derby and an exciting addition to an already desirable city.

Each of the 23 two and three-bedroom homes in Langley Chase will perfectly balance the benefits of urban living amongst open spaces, providing energy efficiency, beautiful interior design, accessibility to the city’s amenities and stunning green spaces.

Langley Chase Development Brochure

To learn more about the Langley Chase development and see what properties are for sale, download the development brochure

Download BrochureLocal Area Information

The development on Radbourne Lane, Mackworth, is close to reputable schools such as Mackworth House School and Murray Park School.

The development benefits from excellent transport links, with easy access to the A38 and A52, and regular bus services into Derby city centre.

Local amenities include a Co-op Food store, Mickleover Golf Club, and Markeaton Park, all just a short drive away.

The town offers a variety of restaurants if you fancy a bit to eat, all ranging from local businesses to chain restaurants.

Derby is one of the most popular cities in the UK for a reason. While smaller than its larger counterpart in Nottingham, Derby still offers an eclectic range of amenities, including premium brands, boutique shops, cultural hotspots, a thriving nightlife, music venues, and theatres, all nestled amongst Derby’s mostly pedestrianised streets.

The city hosts several exceptional educational facilities, with 14 schools rated ‘Outstanding’, as well as the University of Derby, which hosts around 34,000 students.

Derby is the most centrally located city in the UK and, as such, offers unparalleled connectivity. East Midlands Airport is around 20 minutes from the city centre, while Derby Train Station offers links to major destinations such as Birmingham, Manchester, Leeds and Sheffield.

Thanks to investment in the local quality of life, Derby’s population is one of the fastest-growing in the country. Home to around 250,000 people, the city has a relatively young population that is forecasted to hit around 320,000 over the next decade. This alone demonstrates just how popular the city is becoming with homebuyers, especially those seeking a more affordable market while still having a great way of life.

Some of the highlights of Derby include:

Derbion: The largest shopping centre in the East Midlands is home to over 200 stores as well as a cinema, bowling alley and adventure golf course.

Derby Silk Mill (Museum of Making): This UNESCO World Heritage Site is a celebration of Derby’s 300-year history of manufacturing and making.

Derby Arena: A purpose-built arena that hosts both sporting and cultural events alongside comedy, music and pantomime.

Pride Park: The home of Derby County FC and the 16th-largest football ground in the country.

If you’re looking for shared ownership houses in Derby, please pre-register your interest for Langley Chase, and we will contact you with further information.

Shared ownership is a fantastic opportunity if you’re unable to purchase on the open market. It allows you to buy a share in a property on a part-buy/part-rent basis and pay a subsidised rent on the share you do not own.

Over time, you can purchase more shares in the property via the staircasing process. This can be done at any time after initial purchase and reduces the amount of rent you pay.

We offer shares between 10% and 75% of the property value depending on the outcome of your affordability assessment. The higher the share you purchase, the lower the rent will be. You will need to be able to obtain a mortgage for the share you want to purchase unless you have sufficient funds to purchase outright. Deposit amounts will be lower than purchasing a property on the open market, while the combined cost of mortgage and subsidised rent is often cheaper than privately renting.

Am I eligible?

Shared Ownership uses the following criteria to help people get a foot on the housing ladder:- Maximum annual household income of £80,000

One of the following statements must also be true:

- You’re a first-time buyer

- You used to own a home but can’t afford to buy now

- You’re forming a new household - typically after a relationship breakdown

- You’re already part of the Shared Ownership scheme but want to move

- You own a home and want to move but can’t afford the new home that meets your needs

You can purchase between 10% and 75% of the property's full market value. Each home benefits from a 10 year repair period for essential repairs.

You are able to buy more of your home through the Staircasing process, where you can purchase shares in increments of 5%. There is also the option of the 1% Gradual Staircasing Model enabling you to purchase smaller shares each year.