The Elmslie

Semi-Detached House

Part of the Top Farm development

Share this development

The property

Introducing The Elmslie, 3 bedroom semi-detached homes coming to Top Farm.

This beautifully designed two-story home offers 934 square feet of modern living space, perfect for families or professionals seeking comfort and functionality.

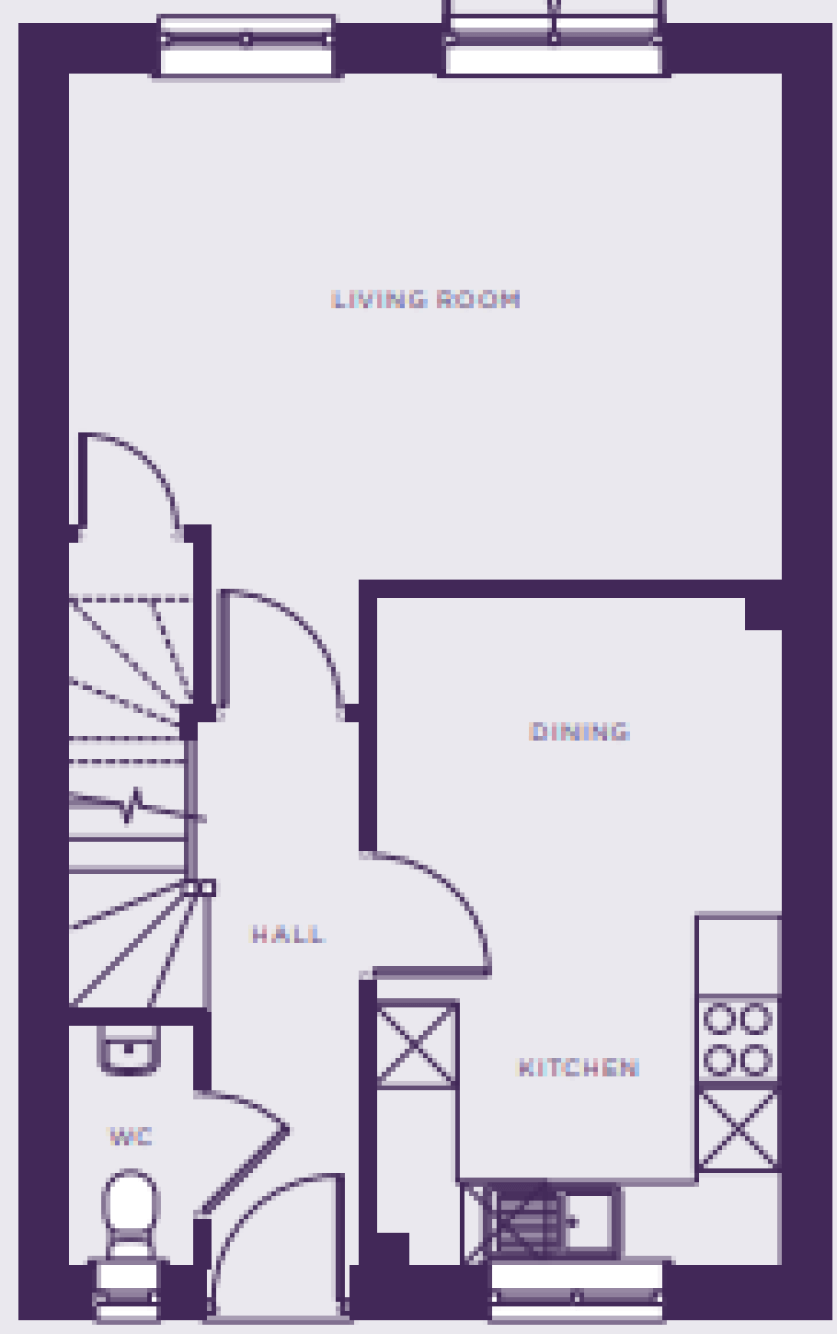

Ground Floor: Upon entry, you’re greeted by a welcoming hallway leading to a stylish WC and a separate staircase. The front of the home features a contemporary kitchen with ample counter space and modern appliances. Adjacent is a dedicated dining area that seamlessly flows into a spacious rear living room, ideal for relaxation or entertaining guests. French doors in the living room open to the garden, enhancing indoor-outdoor living.

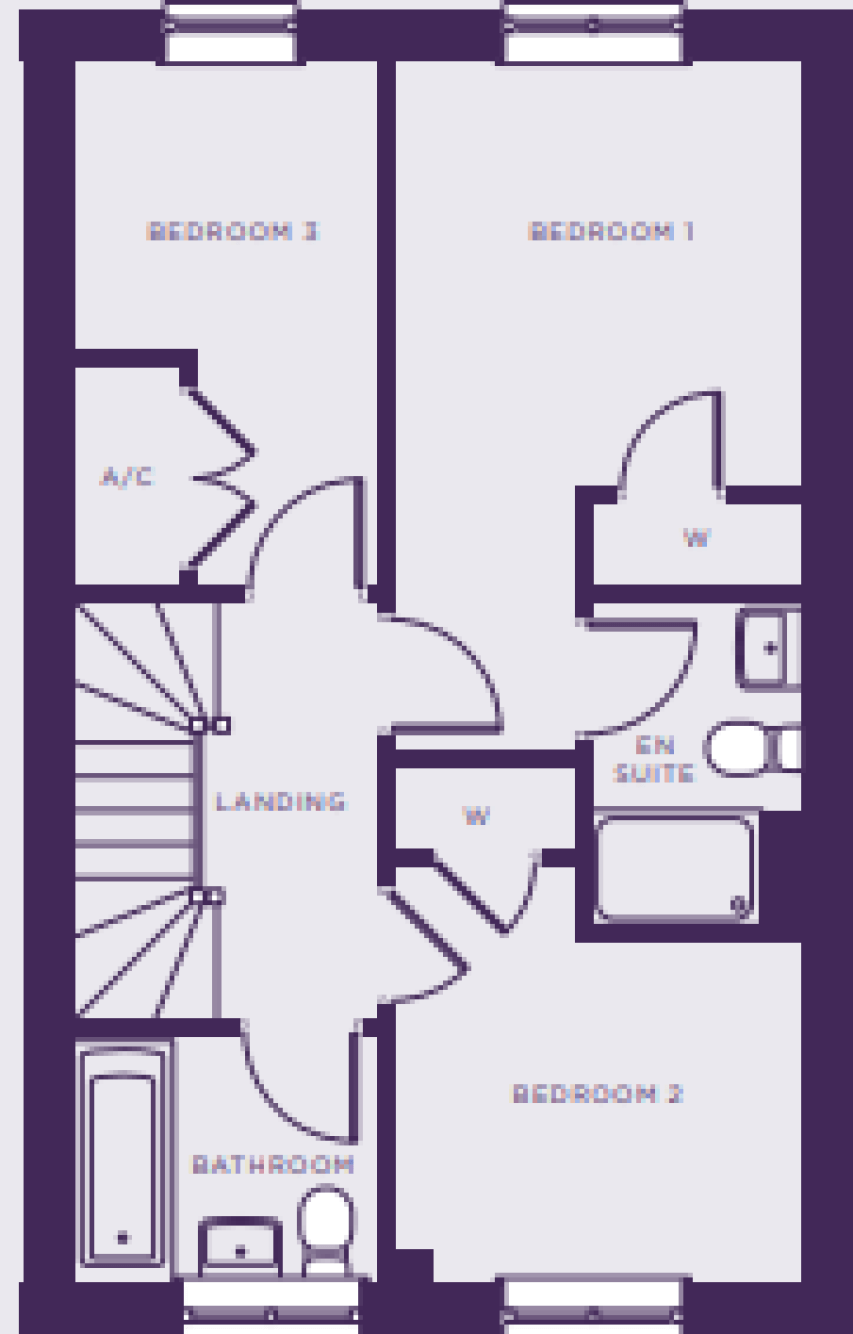

First Floor: Upstairs, you'll find three generously sized bedrooms. The master bedroom boasts a private en suite and built-in wardrobe space. Two additional bedrooms, one also with a wardrobe, share a well-appointed family bathroom. A central landing connects all rooms and includes an A/C cupboard for added convenience.

This thoughtfully laid-out home offers both style and practicality, making it an excellent choice for comfortable, contemporary living.

This development is subject to a local connection to Nuneaton and Bedworth.

Features and description

Development brochure